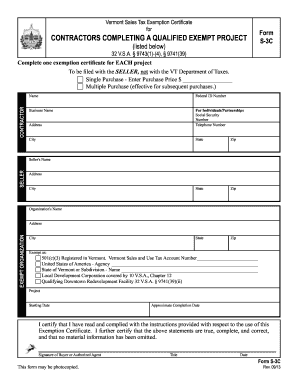

vermont sales tax exemption certificate

Generally retailers do this because they dont want to risk accepting a fraudulent permit. Sales tax exemption certificates legally let buyers get out of paying sales tax.

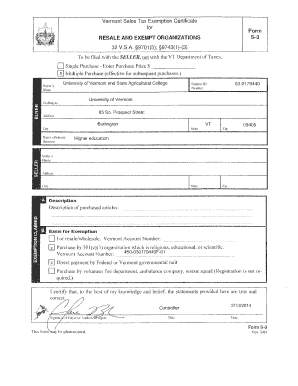

Vermont Sales Tax Exemption Certificate For Form S

Colorado allows a retailer to accept an exemption certificate issued by another state.

. Minnesota Sales. S-3W Vermont Sales Tax Exemption Certificate for Forestry and Wood Products Machinery Equipment and Repair. How to use sales tax exemption certificates in California.

How to fill out the Georgia Sales Tax Certificate of Exemption Form ST-5. The Georgia Department of Revenue created a Sales Tax Certificate of Exemption to make things easier for documenting tax-free transactions. While a sales tax license permits you to collect sales tax a sales tax certificate actually exempts you from paying it.

Retailers can reject legitimate resale certificates. Making it the third highest. For other Colorado sales tax exemption certificates go here.

Uniform sales tax exemption certificates are also acceptable in Florida this is a common or general certificate that maybe used across various states. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. A sales tax certificate also known as a sales tax exemption certificate is a type of certificate that grants businesses exemptions from paying sales taxes on the purchase of select items in select situations.

Filling out the ST-5 is pretty straightforward but is critical for the seller to gather all the information. Or a seller might reject a resale certificate to prevent retail arbitrage. S-3V Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks.

Vermont Sales Tax Exemption Certificate for Purchases of Toothbrushes Floss and Similar Items of Nominal Value to be Given to Patients for Treatment. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. If a non-Colorado-based retailer buying from a Colorado-based seller or the consumer has an exemption certificate issued by another state then the seller is not bound to collect the sales tax from.

The Sales Tax Certificate and Resale Certificate are commonly thought of as the same thing but they are actually two separate documents. The Sales Tax Certificate allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to. But that doesnt mean that sellers legally need to accept them.

Fillable Online Vermont Sales Tax Exemption Certificate For Form Resale Fax Email Print Pdffiller

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

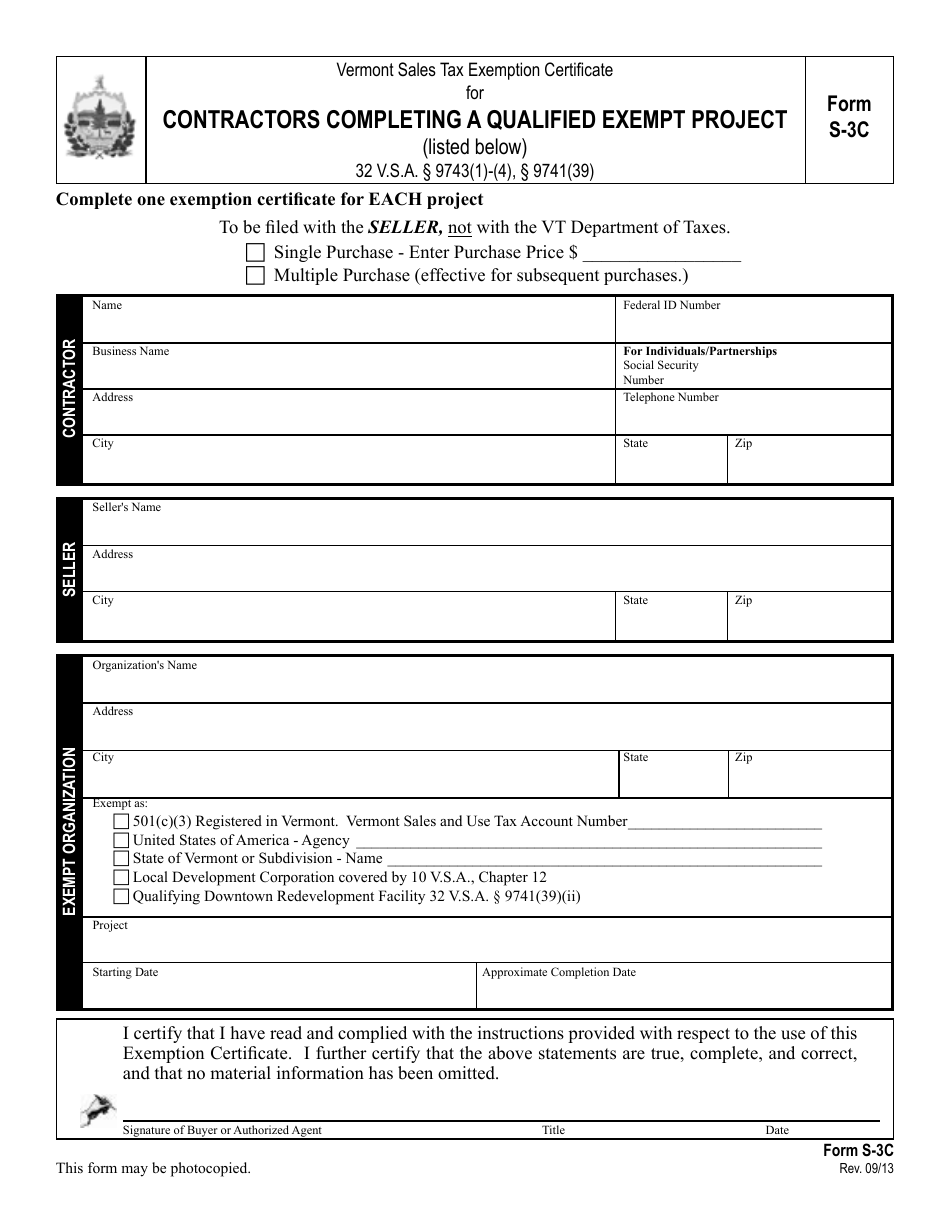

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Fillable Online Vermont Sales Tax Exemption Certificate For Form Fax Email Print Pdffiller

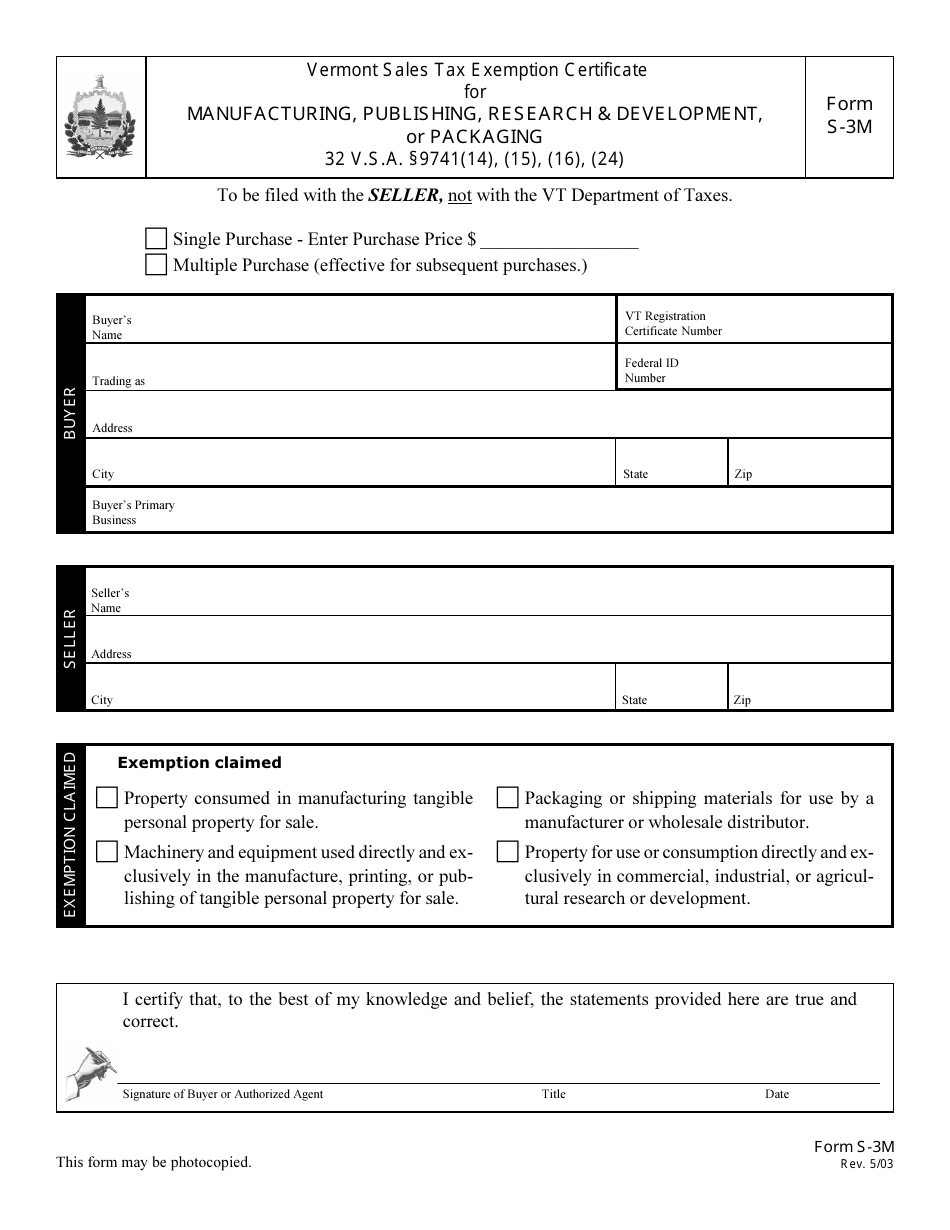

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

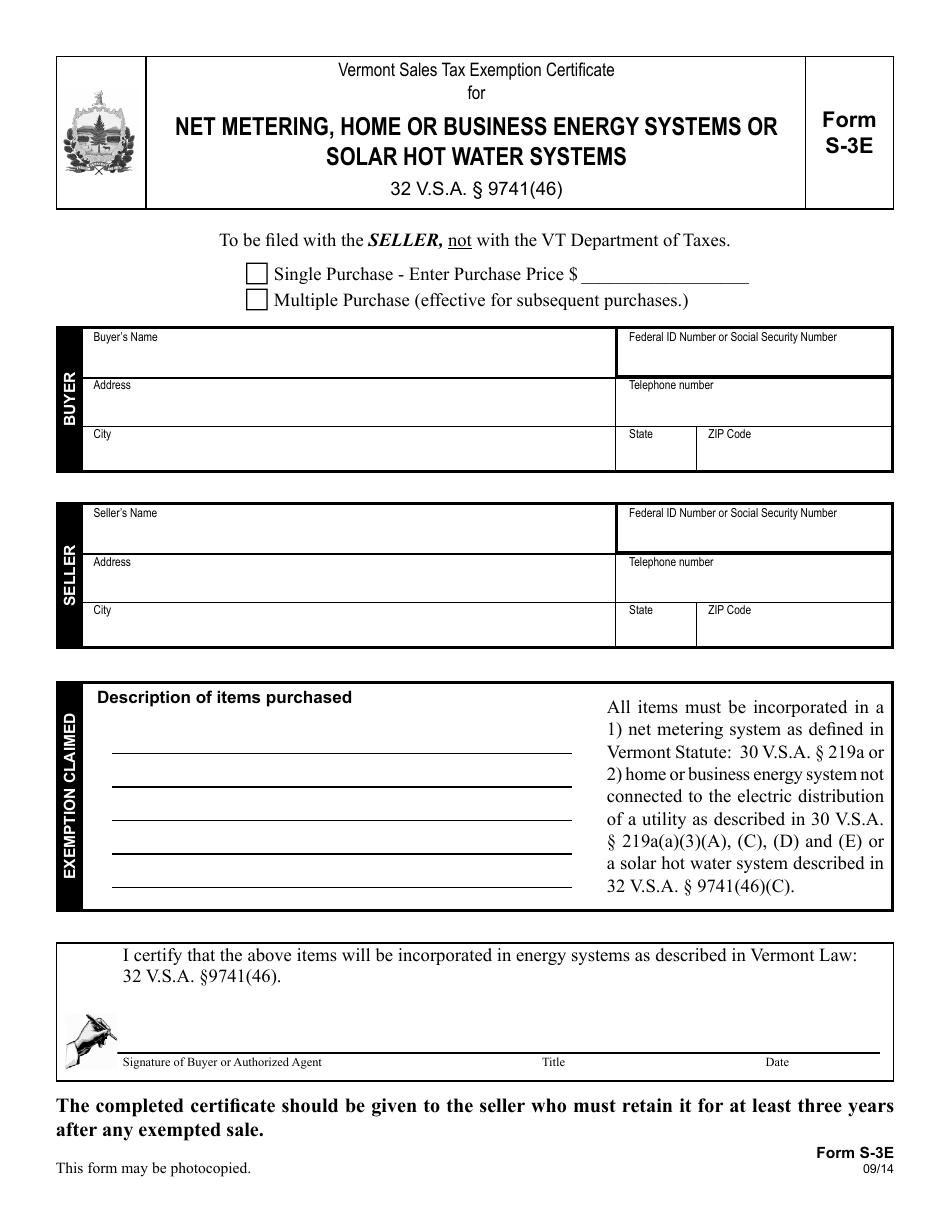

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow