nebraska sales tax rate changes

The Nebraska state sales and use tax rate is 55 055. Over the past year there have been 21 local sales tax rate changes in California.

State Income Tax Rates Highest Lowest 2021 Changes

Florida has a 6 sales tax and Duval County collects an additional 15 so the minimum sales tax rate in Duval County is 75 not including any city or special district taxes.

. To set their own rates and rules. This table shows the total sales tax rates for all cities and towns in Duval County. Avalara Tax Changes 2022 Midyear Update.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. This page will be updated monthly as new sales tax rates are released. Examples of documents available.

Corporate Searches and Document Images Go. With so many jurisdictions generating rates rules and boundaries figuring out your sales tax rate is best accomplished with a street address rather than a city name a street name or a ZIP code. Nebraska has recent rate changes Thu Jul 01 2021.

With local taxes the total sales tax rate is between 5500 and 8000. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated 09082022 Effective January 1 2023 the village of Byron will start a local sales and use tax rate of 1. Select the Nebraska city from the list of popular cities below to see its current sales tax rate. Images of filed business documents are available through the online Corporate Image searches.

The state sales tax rate in Nebraska is 5500. Effective January 1 2023 the village of Sutherland will start a local sales and use tax rate. Contact Nebraskagov 402-471-7810 or 1-800-747-8177.

Nebraska Sales Use Tax Guide Avalara

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

2020 Nebraska Property Tax Issues Agricultural Economics

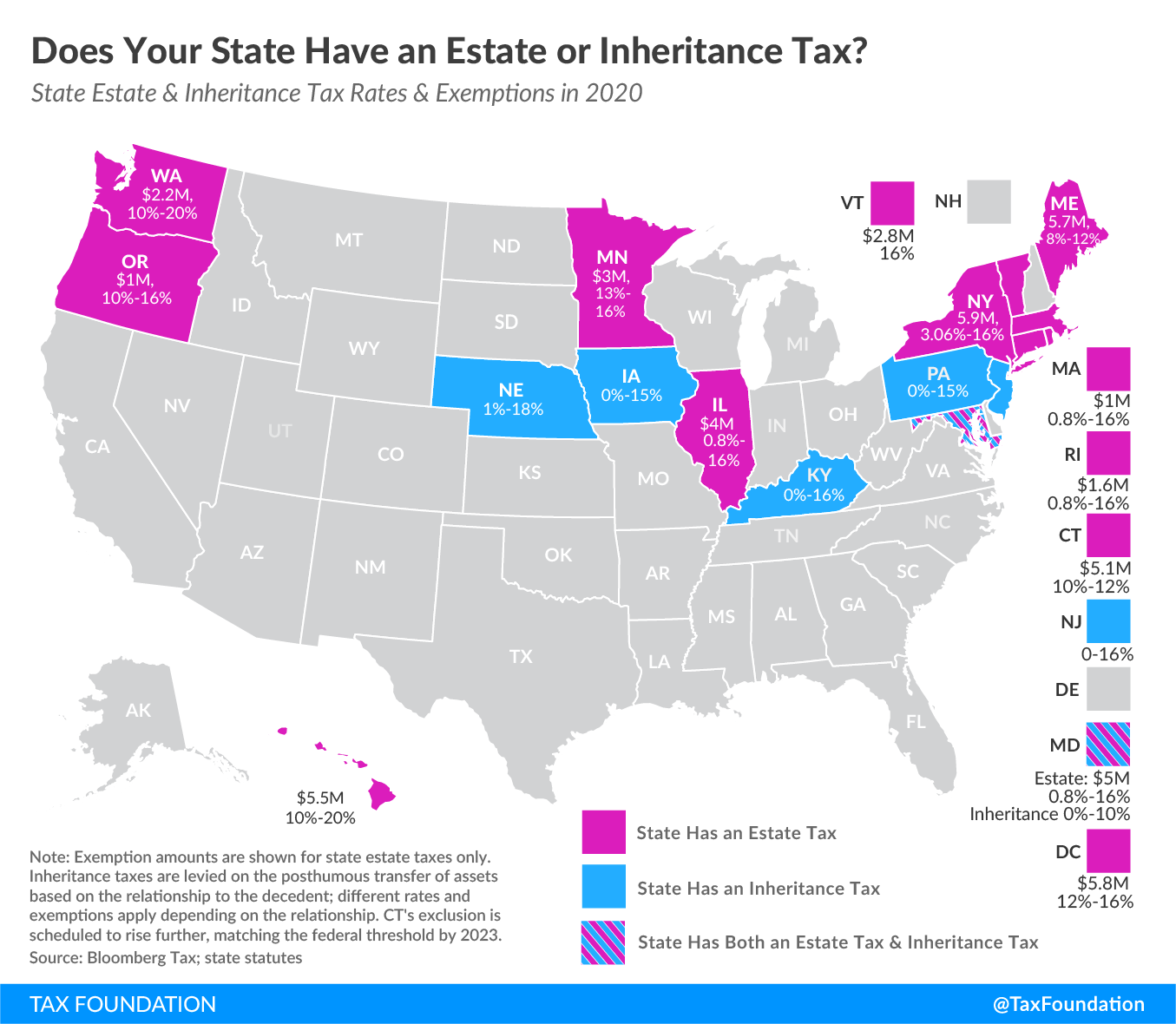

Don T Die In Nebraska How The County Inheritance Tax Works

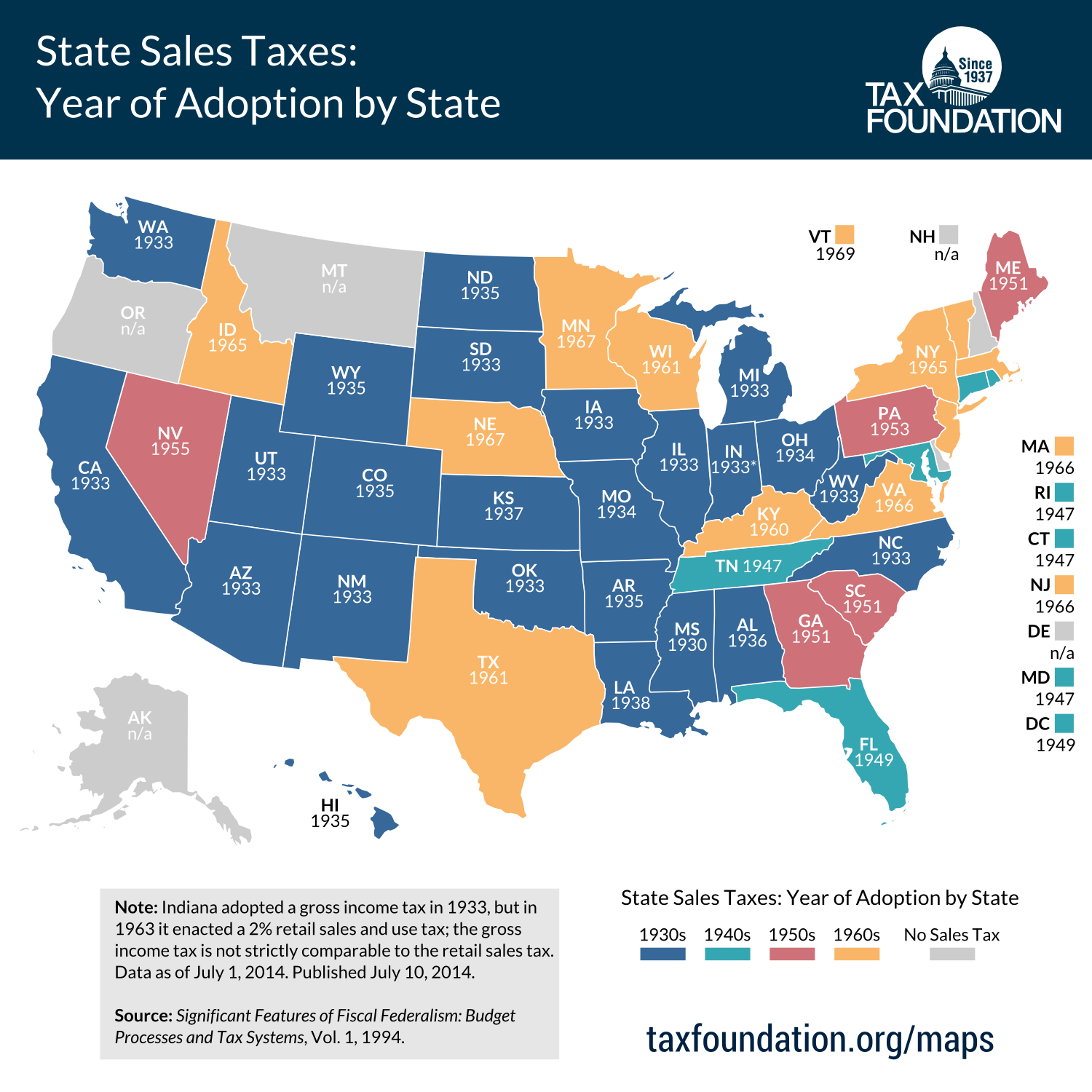

When Did Your State Adopt Its Sales Tax Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

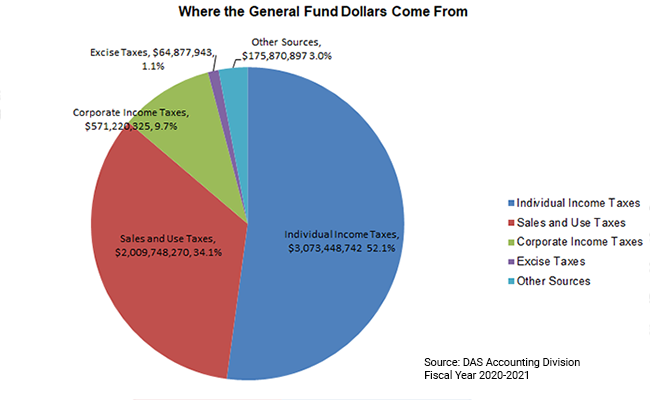

General Fund Receipts Nebraska Department Of Revenue

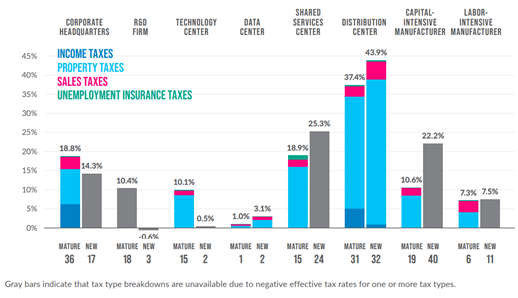

5 Essential Steps To Reform Taxes In Nebraska

Sales Tax By State Is Saas Taxable Taxjar

General Fund Receipts Nebraska Department Of Revenue

How Long Has It Been Since Your State Raised Its Gas Tax Itep

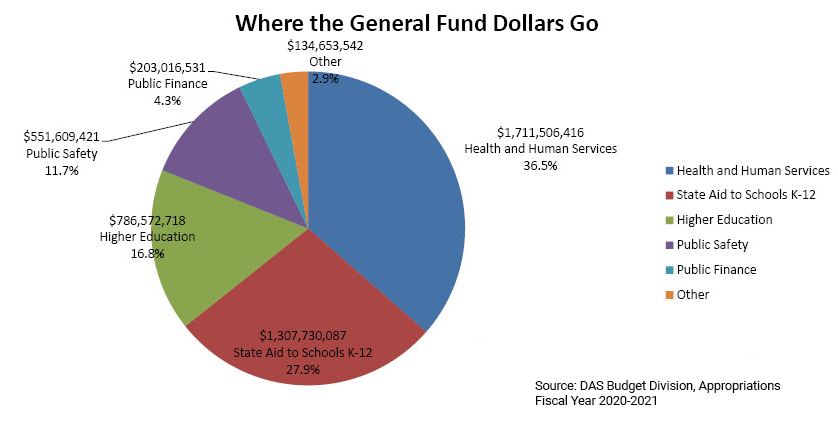

Taxes And Spending In Nebraska

Nebraska Sales Tax Rates By City County 2022

Taxes And Spending In Nebraska

How High Are Cell Phone Taxes In Your State Tax Foundation

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

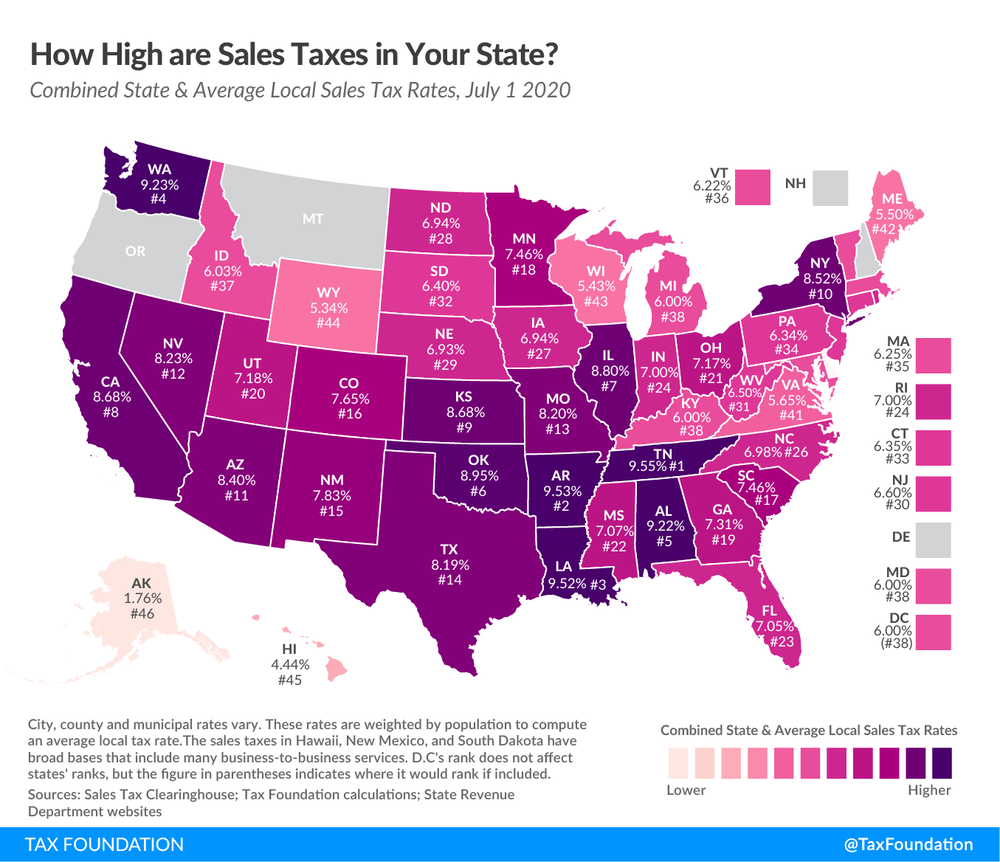

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation